Of several loan providers choose to not ever give so you’re able to consumers having credit scores throughout the Bad variety. Consequently, your ability to help you borrow money and you can resource options are planning be limited. With a get out-of five-hundred, your desire are going to be towards the strengthening your credit score and you can raising the credit ratings before applying for any loans.

One of the best an effective way to generate credit is through getting additional since the a third party affiliate by the a person who already provides higher borrowing from the bank. That have somebody into your life that have a good credit score which can cosign to you is even an option, however it is harm its credit rating for folks who skip repayments otherwise default on the mortgage.

Are you willing to score a credit card with a 400 credit history?

Bank card candidates having a credit score inside variety will get be asked to lay out a safety put. Trying to get a guaranteed bank card is probably the best option. But not, they frequently need dumps of $five-hundred $1,100. It is possible to be able to get an excellent starter charge card from a credit partnership. It is an unsecured charge card, nonetheless it boasts a reduced credit limit and higher notice speed.

Anyway, while capable of getting accepted to possess credit cards, you should make your payments timely and keep your balance less than 29% of your own credit limit.

Could you rating an unsecured loan with a credit score out of 500?

Not many lenders will agree you for a consumer loan having a four hundred credit score. Although not, there are a few that really work which have bad credit borrowers. But, unsecured loans from the lenders include large rates.

It’s best to end payday loans and you will higher-interest signature loans while they carry out a lot of time-label obligations troubles and only contribute to a much deeper decrease in credit score.

To create borrowing, obtaining a card builder loan are a good idea. As opposed to providing you the cash, the money is largely listed in a family savings. After you repay the loan, you have access to the bucks and additionally people attention accrued.

Can i rating home financing which have a credit history from five hundred?

Old-fashioned mortgage lenders will refuse the job that have a good credit history off 500, while the lowest credit score is just about 620.

Although not, for those seeking applying for a keen FHA mortgage, individuals are only necessary to has a minimum FICO get of 500 so you’re able to qualify for an advance payment of approximately 10%. People who have a credit score from 580 normally be eligible for a great down payment as little as 3.5%.

Do i need to rating a car loan having a four hundred credit rating?

Very vehicle lenders does not give in order to someone having a 500 score. If you are able to find approved to own an auto loan which have a four hundred get, it would be costly. If you possibly could improve your credit history, providing an automible will be much easier.

How to Improve a 500 Credit rating

A poor credit rating will reflects a history of borrowing from the bank errors or errors. Such as for example, you have particular overlooked money, costs offs, property foreclosure, and even a case of bankruptcy popping up in your credit file. Also, it is possible that you just have not established credit whatsoever. No borrowing is pretty much the same as less than perfect credit.

step one. Disagreement Bad Membership on your Credit file

It is advisable to grab a duplicate of free credit report regarding each of the around three significant credit agencies, Equifax, Experian, and you may TransUnion to see what is getting stated about yourself. If you discover people negative activities, you can even get a credit fix team such as for instance Lexington Rules. They could help you dispute him or her and maybe have them eliminated.

Lexington Legislation specializes in removing bad activities from your credit report. He has more than 18 numerous years of experience and then have removed over seven million negative circumstances for their website subscribers inside 2020 by yourself.

- tough inquiries

- late money

- collections

- charge offs

- foreclosures

- repossessions

- judgments

- liens

- bankruptcies

2. Pull out a cards Creator Mortgage

Borrowing from the bank builder fund was cost funds that are created specifically so you can assist individuals with poor credit create otherwise rebuild credit history. Indeed, borrowing builder financing do not require a credit check after all. Plus, it should be the lowest priced and you will best way to increase your own borrowing from the bank scores.

Having borrowing builder finance, the bucks lies for the a savings account up until you’ve completed all your own monthly obligations. The loan costs are advertised to one credit bureau, which gives their credit ratings an increase.

step three. Score a guaranteed Charge card

Since the speak about earlier, getting a secured mastercard is an excellent treatment for present credit. Secure handmade cards works much the same as unsecured credit cards. The actual only real change is that they want a protection deposit that can acts as your own borrowing limit. The financing card company helps to keep your own deposit if you prevent putting some lowest percentage otherwise can’t spend your own charge card equilibrium.

cuatro. End up being an authorized User

When you’re near to someone who has excellent credit, getting a 3rd party associate on the borrowing account, ‘s the quickest means to fix boost your fico scores. Their username and passwords gets put into your credit score, which will improve your fico scores immediately.

5. Build Borrowing from the bank by paying Your Lease

Unfortuitously, lease and you will electricity money commonly always claimed on credit reporting agencies. However, having a tiny payment, book reporting services can add your instalments towards credit file, which can only help your alter your credit scores.

Where to go from this point

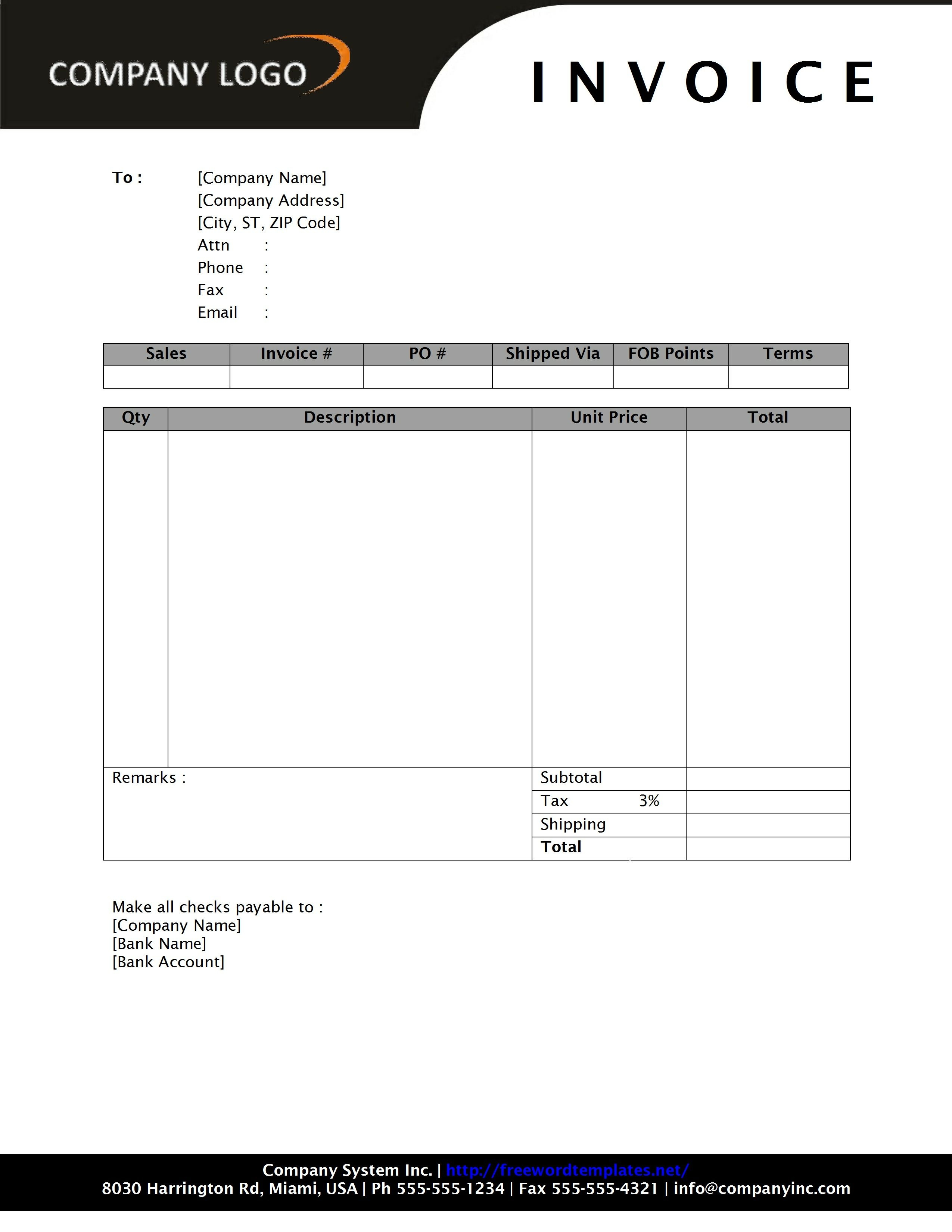

You will need to understand hence products compensate your credit score. As you can tell from the image below, you will find 5 affairs that americash loans Lookout Mountain define your credit rating.

Reduce their stability and keep their borrowing use less than 30%. It’s also advisable to possess different varieties of credit membership to present a very good credit blend as it makes up doing 10% of your FICO score. Very, you ought to has one another installment and you will revolving credit popping up on the credit report.

However, you additionally should work at and make prompt payments from here to your aside. Actually one to later commission could be extremely harmful to their credit.

Length of credit score together with takes on an important part in your credit scores. We wish to reveal prospective financial institutions you have a lengthy, self-confident fee record.

Building good credit doesn’t happens right-away, you could however speed up the procedure by making the newest correct movements. Therefore promote Lexington Law a require a no cost borrowing consultation at (800) 220-0084 and also have become restoring your borrowing today! The sooner you start, the sooner you’re going to be on your journey to that have good credit.

Leave a Reply