Perkins Financing together with may be partially or entirely terminated having consumers who work in certain industries

- The institution forged their label with the financing documents otherwise see endorsements, and also you never ever went to university to the minutes protected by the fresh new forgery.

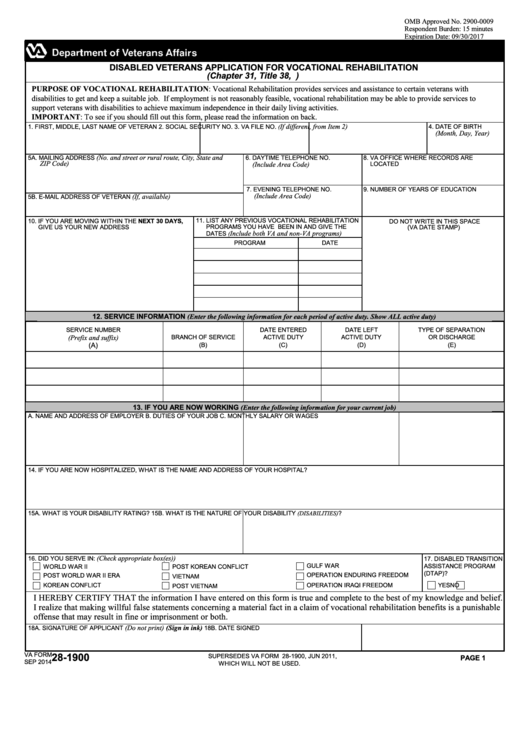

Impairment Discharge. You can discharge the loan in case the Agencies away from Veterans Activities, this new Personal Shelter Management, otherwise a family doctor certifies that you have a complete and you can permanent impairment. Moms and dads with Also Financing may apply for discharge based on their very own disabilities, maybe not those of their child. When the two moms and dads provides a plus Financing and only that gets handicapped, additional need nevertheless pay off the borrowed funds.

Step one to put on will be to notify Nelnet (a company rented by the Department from Knowledge), by contacting 888-303-7818 (8 a great.m. to eight p.meters. EST, seven days a week), e-emailing [current email address secure], otherwise using within disabilitydischarge. You could specify an agent to utilize for you, you earliest have to fill out the fresh new affiliate designation form available at disabilitydischarge. loan in Pawcatuck Connecticut More information about implementing arrive truth be told there too.

Demise Release. Your own estate will not have to pay back the figuratively speaking. Your own home should fill out a unique otherwise authoritative content of the demise certification towards mortgage holder. New death of both dad and mom which have a bonus Financing (of course one another grabbed the actual mortgage) is even known reasons for the new death release, but not brand new death of just one out-of a couple of compelled moms and dads. A father may get discharge of an advantage Financing whether your college student to possess which new mother gotten the loan passes away.

Other Good reasons for Financing Cancellation otherwise Forgiveness. Anyone Service Financing Forgiveness system allows Lead Mortgage individuals operating in a number of jobs to release one left fund immediately following making 120 qualifying payments (roughly the same as a decade regarding costs). Specific instructors with coached for 5 successive many years are also eligible for at the least partial financing forgiveness. Be sure to feedback the main points on most of these applications in the

In the event the mortgage release, cancellation, or forgiveness isnt currently available for you, the federal government now offers choices to decrease your monthly installments, and that means you don’t standard

Bankruptcy proceeding. It is very hard, however impossible, to release a student loan during the bankruptcy proceeding. You ought to prove you to paying the borrowed funds manage bring about an enthusiastic unnecessary hardship for you plus dependents. Process of law generally translate this to help you indicate that you must have really serious monetary issues that are probably persist to own factors outside the handle. It’s always best to ask this new case of bankruptcy courtroom and make this commitment in the course of brand new bankruptcy processing, but when you are not able to do so, brand new bankruptcy judge produces one commitment later on when range efforts on student loan is restored.

Even although you create default, you can get away from default and you can qualify for one of these types of straight down payment arrangements (comprehend the section into the Getting out of Default afterwards contained in this article).

The average federal education loan fees plan, known as Practical Repayment Plan, essentially will provide you with doing a decade to repay your college student financing (up to 3 decades to have combination funds). Almost every other payment agreements get lower your money (at the least initial). This type of agreements do not lower your complete duty, even so they enable you to pay it back even more slow. As a result a lot more appeal would be set in the loan, while could end upwards expenses so much more demand for exchange for less expensive monthly obligations.

Longer Fees Package. This option enables you to increase cost more than a longer period (always no more than twenty-five years), for this reason cutting your payment per month. These plans are often readily available only if you’ve got loans totaling over $29,one hundred thousand.

Leave a Reply