Consolidation doesn’t treat the debt, however it does explain it. However, it may be accompanied by higher costs and you will variable interest rates that’ll be higher priced than you had been previously investing. Just before combining your debt, it is best to speak to a card specialist to decide if or not this is basically the most readily useful direction for your financial situation.

If you choose to have fun with a debt consolidation financing, be careful not to remove additional finance otherwise open the brand new credit cards prior to it being eliminated. Otherwise, you will be with increased loans which you cannot pay-off.

6. Make a crisis Funds

Because you work to your settling the debt, it’s also wise to begin to set money aside from inside the and you can a keen emergency fund. Building an emergency funds will give you much more liberty to manage surprise expenses, rendering it more unlikely that you’ll enter personal debt once again down the road.

Also a couple of hundred bucks may help if you need to has actually automobile fixes done otherwise pay a great physician’s costs. This can slow down the possibilities that you must take-out a quick payday loan or additional personal credit card debt when unanticipated expenditures occur.

Explore a leading-interest savings account otherwise a fund markets membership so your disaster fund earn interest but will still be accessible all the time.

7. Do not Carry out So much more Obligations

Performing obligations while you’re trying to pay-off financial obligation have a tendency to hurt your progress and build so much more attention which you don’t pay off. When you find yourself attempting to pay off your financial obligation, avoid using your own playing cards, beginning the borrowing from the bank membership, or taking right out the latest funds.

You could propose to romantic the credit card accounts entirely in the event the you never imagine you’ll resist together with them.

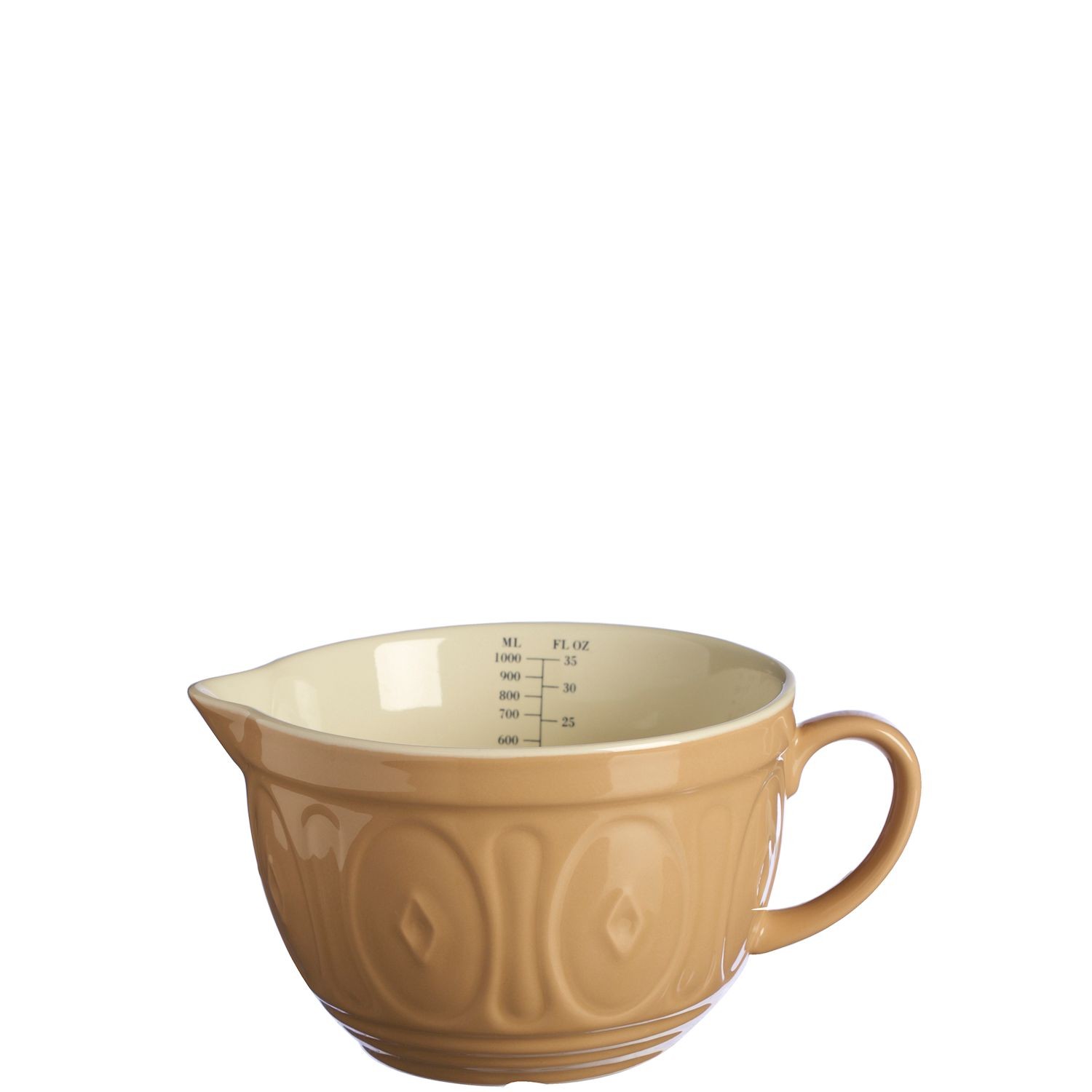

You could frost their handmade cards to eliminate oneself by using him or her if not have to close brand new membership entirely. Place your playing cards into the a bowl or vinyl handbag complete of liquids, then place them in the freezer. You’re going to have to installed a lot of effort locate her or him out of the frost, that will leave you time for you to reconsider using credit ahead of you are of financial obligation.

You might estimate the time it will take you to definitely getting debt-free that with a personal debt cost calculator. Specific let you go into a specific payment Birmingham savings and installment loan per month or a financial obligation-free due date to modify the installment package.

Observe that your debt installment time ount you happen to be spending towards the the obligations and you will if you create additional obligations. Review the debt repayment calculator once or twice a year so you’re able to observe you will be progressing to your your debt-totally free schedule.

8. Bounce Back From Setbacks

A monetary emergency you’ll require that you cut back on your own improved percentage for most months. You might find on your own needing to fool around with playing cards and take away a personal bank loan to handle an urgent state.

When that occurs, recalculate your allowance and select backup together with your payments as the quickly that you can. Defeat frustration and keep maintaining the debt cost on track.

Performing loans milestones may help you stay concentrated and you may recommended if you find yourself you have to pay out-of the debt. By the celebrating the small achievements, eg paying the first financing otherwise eliminating ten% of your own total financial obligation, you could make it easier to stand driven towards the removing your own obligations entirely.

2. Manage your Spending

Make use of your month-to-month finances to choose just how much you could potentially invest towards the obligations fees every month. Deduct their expenses out of your earnings, including one unpredictable otherwise unexpected expenditures that may appear while in the new times. What’s left-over after you have secure all your required costs try the amount you could potentially dedicate to the debt. Use this count in your obligations bundle.

When you are having problems dealing with a lot of costs, you could potentially consolidate them on the a single personal debt, even if you should consolidate that have poor credit. This is certainly a personal loan which covers the price of the current expense, causing you to be with just one commission per month.

Leave a Reply